4 Apr 2024

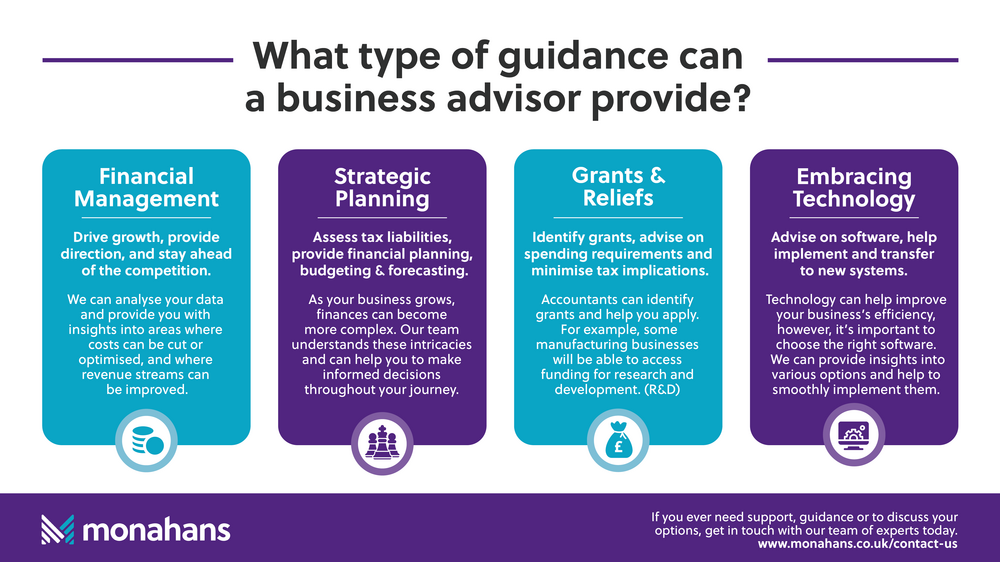

What type of guidance can a business advisor or accountant provide?

In the dynamic landscape of modern business, navigating the complexities of finances and strategic planning can be overwhelming. Whilst there are a significant number of resources available online, the volume of information can make it a minefield to comprehend, and it can be difficult to relate to the nuances of a business.

Having the invaluable expertise of a business advisor or accountant allows a business to gain tailored advice. Beyond simply crunching numbers, accountants serve as strategic partners, offering guidance that can steer your business towards success. So, what type of guidance can these professionals offer?

Financial management

One of the primary responsibilities of an accountant is to assist in effective financial management. This involves processes such as cash flow analysis, assessing tax liabilities and financial planning. By analysing a business’s financial data, they can provide insights into areas where costs can be cut or optimised, or ways in which revenue streams can be improved to enhance the position of the company. This guidance is essential for ensuring the long-term sustainability and profitability of your business.

Financial management also involves budgeting and forecasting. Accountants help businesses to allocate their resources effectively to align with their goals and to create a realistic budget based on industry benchmarks and the history of the company. Predicting future cash flow is imperative to make informed business decisions. Having an official roadmap can help organisations to anticipate potential challenges and provides them with opportunities to adjust their financial plans accordingly. This can help business owners to plan the months ahead more strategically. For example, helping a business to decide if now is the right time to invest in new services or new hires for example to facilitate growth in future years.

Effective strategic planning

When it comes to effective strategic planning, it is crucial for businesses to drive growth and stay ahead of the competition. Accountants bring a strategic perspective to the table, as they often have experience of dealing with similar scenarios. Whether a business is expanding into new markets, launching a new product line, or restructuring a business model, its strategic guidance can provide clarity and direction. As part of Sumer Group, Monahans has an extension of expertise across the country to utilise if the case is particularly niche or challenging.

Each business has individual and unique goals and growth is often on a long list of priorities. As businesses grow, finances become more complex, so it is essential to have an accountant who understands the intricacies of financial management during the scaling period. An accountant can assist businesses in consolidating different revenue streams into a more streamlined process for example, which can be key in informing decisions. It’s also helpful to have an expert on board throughout the growth journey as challenges can present themselves at any stage.

A greater awareness of grants and reliefs

If a business qualifies for certain grants or reliefs, accountants can identify these and help with the application process. For example, some businesses in the manufacturing industry will be able to access funding for research and development (R&D). If a business is awarded funding or a grant, accountants can ensure the funds are strictly being used to fulfil the requirements to avoid any tax implications.

Embracing technology

In a world increasingly reliant on technology to improve business efficiency, it’s important to choose software and tools that fit with that firm’s processes. Accountants will have insights into different options and can help implement them and transfer crucial information over.

For instance, if HMRC was to launch any new digital platforms, accountants will be able to help clients to navigate the developments. Making Tax Digital (MTD) is a government initiative aimed at helping individuals and businesses to stay on top of their tax affairs and is now due to be launched in 2026. Our team is on hand to help with those looking to make the transition prior to, and after, this deadline.

If you ever need support, guidance or to discuss your options, get in touch with our team of experts today.

Clare Bowen