13 Sep 2024

The agriculture sector: a look back on this year’s harvest

Many of our current conversations with clients are centred around cashflow management and tax planning for the year-end. Looking back, certainly for farmers and rural businesses, it has been a variable year.

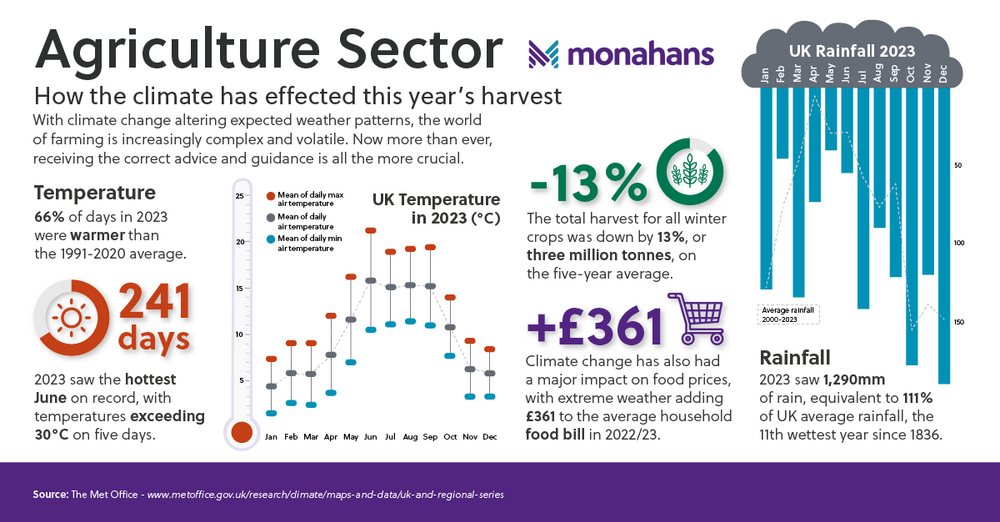

Spring was exceptionally dry, followed by intermittent periods of rain as we moved through the year. As a result some of our farming clients finished the harvest earlier than anticipated. For others it has been a longer process, and the harvest work period was more protracted than usual.

Over the last few years, the harvest window has been starting earlier and becoming shorter. This year, however, it appears to be returning to more traditional timings.

Farmers’ main concern are of course yields, and this year has shown pretty average results. It hasn’t been a bad year by any means, and I think the majority of clients are viewing this as a return to normal trends, but whether it is deemed to be a largely positive or negative year will be ultimately determined by price.

Forward selling crop

We have seen some resistance among clients to forward sell too much of their crop. Traditionally, farmers tend to forward an element of their crop just for the reassurance of securing a price for at least a portion of their produce. But following a spike in price in February/March time, this has since dropped away, leaving many unwilling to commit at a price lower than seen earlier in the year.

So although this year offered an average yield, the price will be achieved on the crops that have been harvested, and that is yet to be seen.

Potential cash flow squeezes

One potential consequence, if prices achieved are average or lower than in the last two years, is that clients may experience some cashflow squeezes as we approach January 2025.

This is because January’s tax payments will be based on last summer’s harvest and the prices that farmers were getting at the point in time, but what farmers are bringing in may be less.

Therefore, it is crucial that clients speak to us early for support with their accounts so that they can best manage their January tax payments and perhaps consider payments on account. Or if it has been a particularly good year, we can help them to mitigate potential tax liabilities, particularly considering the upcoming budget.

Keeping an eye on reducing subsidies

The reduction in subsidies continues to be a key concern for clients and we have seen a much more enthusiastic uptake in alternative environmental schemes where possible.

Getting ahead of succession planning

There are likely to be significant changes in the inheritance tax (IHT) and capital gains tax landscape as part of the October budget so if clients have plans to address their succession plans, we would advise that now would be the time to do so, whilst we know what the rules entail.

The world of farming is complex and volatile, which makes receiving the correct advice and guidance all the more crucial.

No matter what is thrown at you, planning is key. Our specialists will be able to help you to factor upcoming changes into your forecasting and forward planning, as well as helping you to navigate tax changes.

If you need support with your rural business or landed estate, get in touch with Andrew today, who would be more than happy to help.

Andrew Perrott