12 Nov 2024

An overview of the education sector – as told by our research.

At Monahans, our client base is broad and varied meaning that we never offer a one-size-fits-all approach, every industry and organisation faces its own unique challenges. These issues are also impacted by internal and external pressures such as the political and economic landscape.

It is crucial that we have a comprehensive understanding of the markets in which we operate, not only in order to build a picture of the challenges that are being faced but also to ensure that the service we offer continues to address those issues.

As part of these efforts, we surveyed more than 300 micro, small, medium and medium/large-scale enterprises throughout the region, to find out from management teams, senior executives, and business owners how businesses have been faring over the last year.

The education sector is just one of the fields in which our clients operate. Not only are educational institutions an integral part of our client base, but the service that they offer is also a crucial pillar of society. According to the Department of Education there are currently 32,163 schools in the UK, including 3,079 nurseries or early-learning centres, 20,806 primary schools and 4,190 secondary schools. As well as 2,461 independent schools and 1,546 special schools. And as of Q2 of 2024 the UK education sector employed over 3.5 million people.

We know that educational organisations face a raft of unique challenges, and our team will be supporting them every step of the way. We spoke with James Gare, Partner, about our research findings, and how organisations are faring.

Silver linings

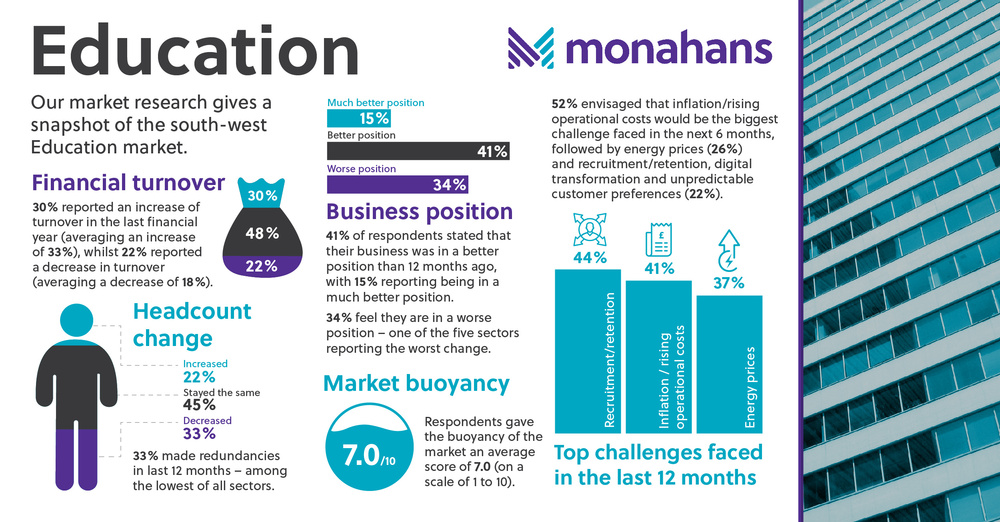

It has been a challenging 12 months, so it is brilliant to see nearly half (41%) of educational organisations reporting that their business is in a better position than it was 12 months ago. 15% of which stating that they’re in a much better position. Respondents also gave the buoyancy of the market an average score of 7.0 (on a scale of 1 to 10) – matching the average given across all sectors.

A third of respondents (30%) also reported an increase in turnover in the last financial year, with an average increase of 33%, whilst 22% reported a decrease in turnover.

We know that recruitment and retention has been a major focus for the sector, as they try to appeal to and hold onto top quality talent. Therefore, it is positive that our research found education to have one of the lowest redundancy rates of all sectors. 22% of respondents also reported an increase in headcount, averaging an increase of 59% – the highest of any sector. At the same time, however, 33% reported a decrease in headcount.

A challenging landscape

Despite these pockets of positivity, however, our survey results also confirmed what we already knew from our conversations with clients - that some organisations are still in need of support.

A third of businesses reported being in a worse position than the 12 months prior and inflation/rising operational costs continue to be a real concern. Academies, for example have experienced increased pressure on their reserves due to the cost of services and in particular rising energy bills which saw a 400% rise in the last year. On top of this, they have been struggling to keep up with ongoing adjustments to staff wages.

In our survey, respondents in the education sector reported the top five biggest challenges faced in the last 12 months to be recruitment/retention (44%) inflation/rising operational costs (41%), energy prices (37%), generating new business (26%) and supply chain issues (19%).

Many of these are also anticipated to be an ongoing cause for concern in the coming months. 52% envisage that inflation/rising operational costs would be the biggest challenge faced in the next 6 months, followed by energy prices (26%) and recruitment/retention, digital transformation and unpredictable customer preferences (22%).

A look ahead

Over the next 12 months, we hope to see legislation designed to help educational institutions reach a more stable position and we’ll be ensuring that our clients in the sector are kept abreast of any such developments. In the meantime, we will continue to help our clients to remain operational through sound financial planning.

At Monahans, the consultative aspect of our work is just as important as the technical, and much of our value comes from acting as a sounding board and giving our clients reassurance that they have an expert with their best interests at heart.

Our team is here to provide expert, proactive and timely advice that will empower educational institutions to tackle any challenges head on and create long-term solutions.

To understand the best route for you, contact me directly for help and advice or complete our form for more information.

To download the full market report, visit the Monahans website: https://www.monahans.co.uk/publications/swresearch-july24

James Gare