8 Oct 2024

What our market research revealed about the state of the Retail and Wholesale sector

At Monahans, we work hard to ensure that our clients are consistently receiving the best possible service. To do so, it’s imperative that we provide guidance that takes into account the wider economic climate and consumer landscape, and that we fully understand the unique challenges that our clients are facing.

To get a sense of how the south-west business community has been faring over the past year, we recently commissioned a survey of management teams, senior executives, and business owners at more than 300 micro, small, medium and medium/large-scale enterprises throughout the region. The findings highlight industry-specific issues, as well as focusing in on areas such as turnover, headcount, and market buoyancy.

The retail and wholesale sector was one area we felt it was crucial to survey, not only due to its importance to Monahans’ client base, but also the wider economy. According to government data there were 314,040 retail businesses in the UK as of 1 January 2023, and the sector employed 2.7 million workers in 2022. Internet retailing is particularly popular in the UK, even more so than in other European countries and the USA.

Over the last few years businesses operating in retail and wholesale have had to work hard to regain profitability and stability following the Covid-19 pandemic and at a time when inflation has been keeping consumer spending down. We speak with Simon Tombs, Managing Partner, about how the sector is faring and how Monahans has been supporting businesses in 2024.

An overview of the market

The retail and wholesale sector is continuing to face the reverberations of COVID-19 restrictions. At the onset of the pandemic in March 2020, retail sales fell dramatically as lockdown restrictions closed non-essential retail stores. Trends in sales were erratic for the remainder of 2020 and 2021 though, overall, broadly returned to pre-pandemic levels from March 2021. Online sales rose sharply at the onset of the pandemic as physical stores were closed, reaching a record high of 37% in February 2021.

Since then, factors such as changing consumer behaviour, increased internet shopping and challenging economic conditions have been changing the way retailers operate and engage with their customers, as they work to appeal to consumers amid rising inflation.

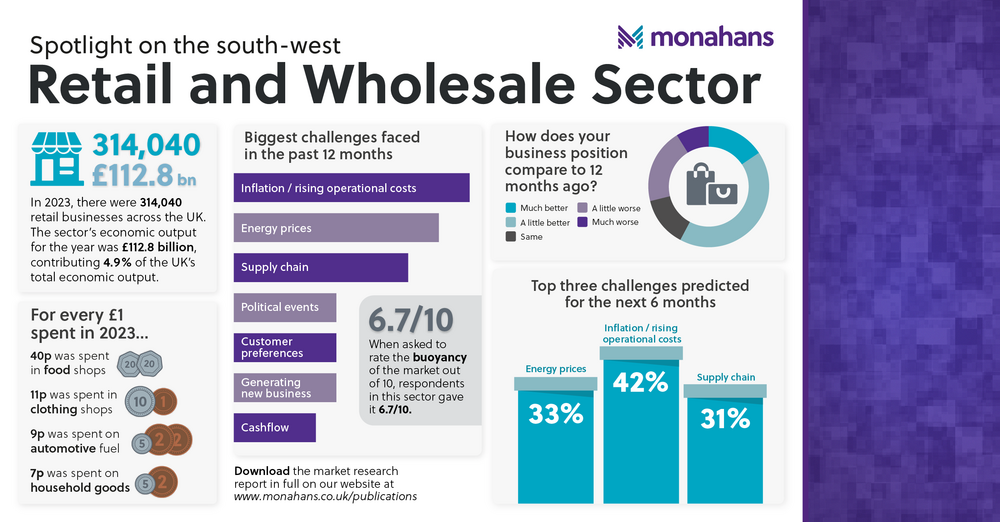

Our research paints a similar picture – 51% of businesses operating in retail and wholesale reported inflation/rising operational costs as the biggest challenge faced in the last 12 months and 42% envisage that this will continue to be the case over the next six months.

Businesses also cited rising energy prices (44%), supply chain issues (38%), political events (22%) and unpredictable customer preferences (22%) as the main issues faced in the last year, all of which are anticipated to remain as central concerns in the near future.

Bouncing back

Despite these challenges, the sector does appear to be slowly bouncing back. The UK retail sector’s economic output was £112.8 billion in 2023, accounting for 4.9% of the UK’s total economic output and a 2.4% increase on 2022.

For every pound spent in 2023: 40 pence was spent in food shops – a 9% rise on 2022;

11 pence was spent in clothing shops (including textiles and footwear) – an increase of 7% on 2022: followed by 9 pence spent on automotive fuel and 7 pence spent in household goods shops, including electronics and furniture stores.

From our research, south-west businesses operating in the sector also seem to be fairing reasonably well. Respondents gave the buoyancy of the market an average score of 6.8 out of 10 (1 being the lowest and 10 the highest), over half (58%) reported that their business was in a better position than it was 12 months ago and 44% saw an increase in turnover during the same period.

When it comes to recruitment and retention, businesses also seem to have been regaining stability following the pandemic. Nearly a third (29%) reported an increase in headcount in the last 12 months, averaging an increase of 38%, and only 22% made redundancies in the last year – one of the lowest figures of sectors surveyed.

Where do we go from here?

As businesses face further uncertainty in the coming months, we will be supporting them to effectively plan ahead and ensure that they have all of the cashflow information that they need to make informed decisions, as well as keeping them abreast of the tax credits and grant options available.

Whilst unpredictability and uncertainty will always be part of running a business, at Monahans we help businesses to concentrate on controlling the controllables. Our goal is to take some of the weight off business-owners’ shoulders, so that they can concentrate on running their businesses. Whether that be through offering sound business advice or supporting with cashflow management, recruitment, payroll or financial planning, we are here to help them reach their goals.

If you need support with the running of your business or would like to discuss your specific needs, please contact Simon Tombs who would be more than happy to discuss your options.

To download the full report, visit the Monahans website: https://www.monahans.co.uk/publications/swresearch-july24

Simon Tombs