25 Sep 2024

‘Our survey said’: Tourism and Hospitality

To ensure we are providing an exceptional service to all our clients, it’s imperative that we – as the south-west’s leading chartered accountancy and business advisory firm – keep our finger on the pulse of the business market.

With turbulence in the economy, this is especially the case, so we recently commissioned a survey of management teams, senior executives, and business owners at more than 300 micro, small, medium and medium/large-scale enterprises throughout the region, to paint a picture of the challenges south-west business are facing. And how they’re faring amid fluctuating market conditions.

Across the wide range of sectors in which our clients operate, the results were fascinating. Tourism and hospitality stood out as having to overcome a unique set of challenges, but this isn’t particularly surprising, given how seriously the industry was affected by COVID-19 and the continuing repercussions. Indeed, businesses operating in tourism and hospitality have had to work hard to regain profitability and stability, and many who received loans in order to help them to stay afloat during lockdowns have been expected to pay them back during a time when inflation is keeping consumer spending down. But the nature of business sentiment across the sector was interesting.

Market overview

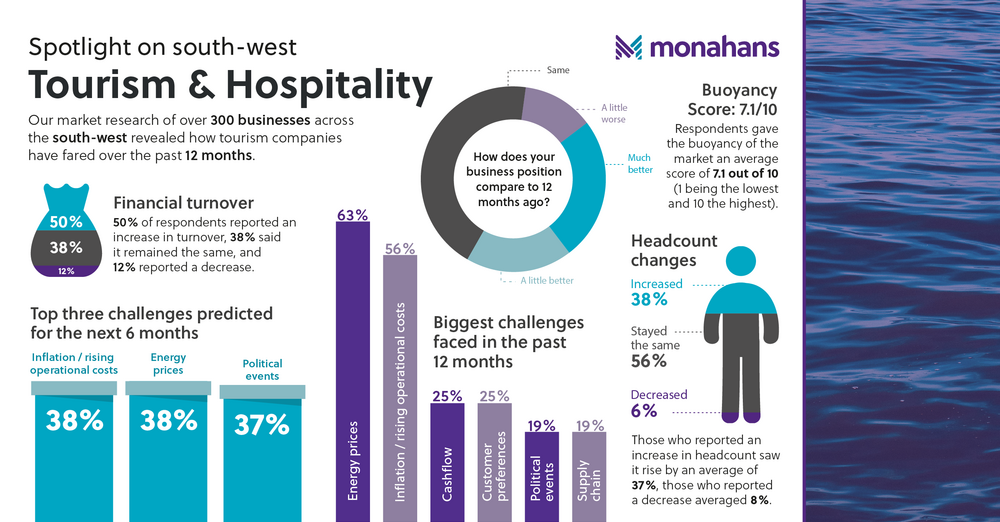

Despite the ongoing issues over a challenging 12 months, respondents gave the buoyancy of the market an average score of 7.1 out of 10 (1 being the lowest and 10 the highest). Considering it wasn’t long ago that the world was completely closed to tourism and hospitality, this is a strong figure, especially when the likes of retail, education, professional services, manufacturing and others ranked their sector buoyancy below 7.

Such has been the bounce back from the pandemic that half of south-west tourism and hospitality businesses have reported an increase in turnover in the last financial year, averaging an increase of 36%. This is higher than the mean increase of 32% across all sectors. Similarly, 38% of businesses reported an increase in headcount, by an average of 37%, which is also higher than the mean of 33%.

Challenges faced

The outlook isn’t bleak, then, far from it, but companies have most certainly been held back, with increases in energy prices hitting these businesses hard, compounded by rising operational costs. 63% of tourism and hospitality companies reported energy prices as the biggest challenge faced in the last 12 months, followed by inflation/rising operational costs (56%). From our conversations with clients, with costs rising, many are also struggling to retain staff – while many were able to increase turnover, this was balanced out by 31% making redundancies in the last year. Recruitment has also been a challenge.

Where do we go from here?

The buoyancy figures show that there is positivity in the market, albeit with less than half (44%) of respondents reporting that their business was in a better position than it was 12 months prior (and only 25% of those reporting being in a much better position). Companies anticipate that energy prices and operational costs will continue to be the biggest challenges that they will face as we head into 2025 and beyond.

But, despite these obstacles, we hope that increased economic and political stability will continue to fuel the recovery of the sector this year. The largely positive turnover and headcount figures promise to continue moving in the right direction and we will be supporting these businesses to balance their cashflow and plan ahead in order to navigate changing consumer behaviour in the months and years to come.

If you need support with the running of your business or would like to discuss your specific needs, please contact Simon Cooper who would be more than happy to discuss your options.

To download the full report, visit the Monahans website: https://www.monahans.co.uk/publications/swresearch-july24

Simon Cooper