7 Aug 2024

Monahans’ South-West Market Research Report: Gauging business sentiment across the south-west

As the south-west’s largest chartered accountancy and advisory firm, Monahans serves businesses of a wide range of sizes which operate across multiple sectors. As such, it is crucial that we keep our finger on the pulse of market sentiment and the unique challenges that our clients face, to ensure that the service that we offer continues to fit their evolving needs.

As part of our efforts to gauge how businesses in the region have been faring over the last year – and their expectations for the coming months – we conducted research to gain comprehensive insights as to the level of market confidence, the challenges businesses have faced and where they are in most need of support. gain strong insights into the market we operate in.

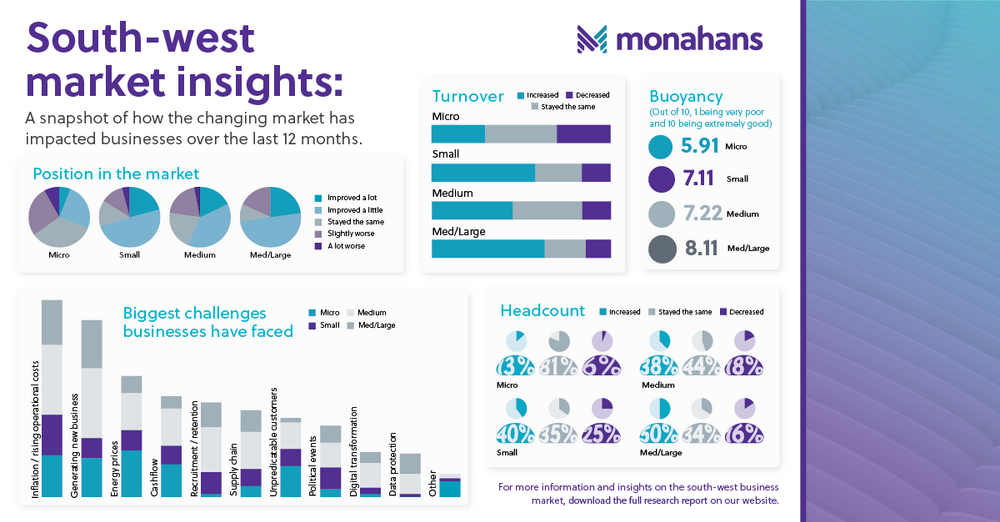

Partnering with market research agency Atomik, Monahans commissioned a survey of management teams, senior executives, and business owners at more than 300 micro, small, medium and medium/large-scale enterprises throughout the region. The report has shed light on the economic landscape in the south-west, including revealing that over a quarter (28%) of organisations have implemented redundancies over the past year. We give a snapshot of our findings below.

The impact of economic challenges

It is no surprise that the last 12 months have been particularly challenging, for businesses of all sizes. The primary issues highlighted in the south-west market research report include rising inflation, increasing operational costs, and a reduction in spending due to interest rates climbing above 5%. These factors have posed significant hurdles, especially for small businesses with 11-50 employees, with nearly half (46%) identifying these economic pressures as their greatest challenge.

Looking into specific industries, the hospitality and tourism sectors have felt the brunt of these economic difficulties, with 56% of businesses rating it as their main concern. However, this challenge is overshadowed by the impact of soaring energy prices, which 67% of companies in the sector identified as their biggest issue over the past year. Many businesses have had to deal with the overwhelming running costs of their business which has forced them to prioritise the areas that help them grow and claw back on others, for some, that has meant reducing their workforce.

Interestingly, the data highlighted that micro, and small businesses have largely avoided laying off staff despite facing the pressure of increased operational costs. On the other hand, nearly half (45%) of these larger enterprises have made redundancies to cut costs, resulting in a 19% reduction in headcount to balance finances during times of added pressure. Conversely, micro businesses (1-10 employees) have found generating new business to be their most significant hurdle, yet only 8% have resorted to redundancies. The causes can vary, from employee loyalty to riding the wave of uncertainty, struggling businesses are following different strategies to survive.

Market sentiment

Despite challenges, the overall market sentiment remains positive. While only a third (31%) of micro businesses feel they are in a better position than a year ago, a substantial majority of small (70%), medium (57%) to large (73%) businesses reported improved conditions compared to the previous year. Overall, 55% of businesses expressed a positive outlook on the remainder of the year.

Businesses were also asked to rate their market’s buoyancy on a scale of one to ten, with ten being extremely good and one being very poor. Micro businesses gave an average score of 5.9, while remaining business sizes rated it over 7, giving an average score of 7.0 across all respondents. In terms of specific industries, charity and not-for-profit organisations reported the lowest buoyancy score at 6.2, whereas the energy sector was the most optimistic, with a score of 8.2.

Financial performance

When it comes to the numbers, many businesses have experienced growth, with nearly half (47%) reporting an increase in turnover, averaging a rise of 31.5% compared to previous years. Only one in five (19%) reported a decrease in turnover, which is positive considering the level of economic challenges. As the economy stabilises, we hope to see this number drop and for businesses to feel more secure in the coming months.

Rightly so, the majority of businesses are largely feeling optimistic, which overrules the ‘doom and gloom’ narrative we are seeing in the news agenda. The fact that half of businesses have reported increased turnover whilst navigating turbulent financial conditions demonstrates a level of resilience and optimism, which puts them in good stead to capitalise on improving market conditions.

We understand the varied and unique issues that businesses are facing, and we know our clients are working hard to ride the wave of fluctuations. We are committed helping all businesses to be as successful as possible and will continue to support our clients to effectively manage cashflow and implement strong financial plans, so that they are ready to tackle anything that is thrown their way.

If you are looking for a team of experts to help you achieve long-term growth, get in touch with the team today.

To download the full report, visit the Monahans website here.

Simon Tombs