29 Nov 2022

Can you afford to have your tax affairs investigated?

The Coronavirus Job Retention Scheme was a godsend to businesses during the pandemic, helping many stay afloat through what was an exceptionally challenging time. But the estimated £70 billion that it cost the Government between April 2020 and November 2021 has left the powers that be with a considerable hole to fill.

Furthermore, the ease with which businesses could claim furlough for their employees prompted a surge in fraudulent claims, including one case that saw an Indian fraudster set up four London companies and claim £27million in furlough payments.

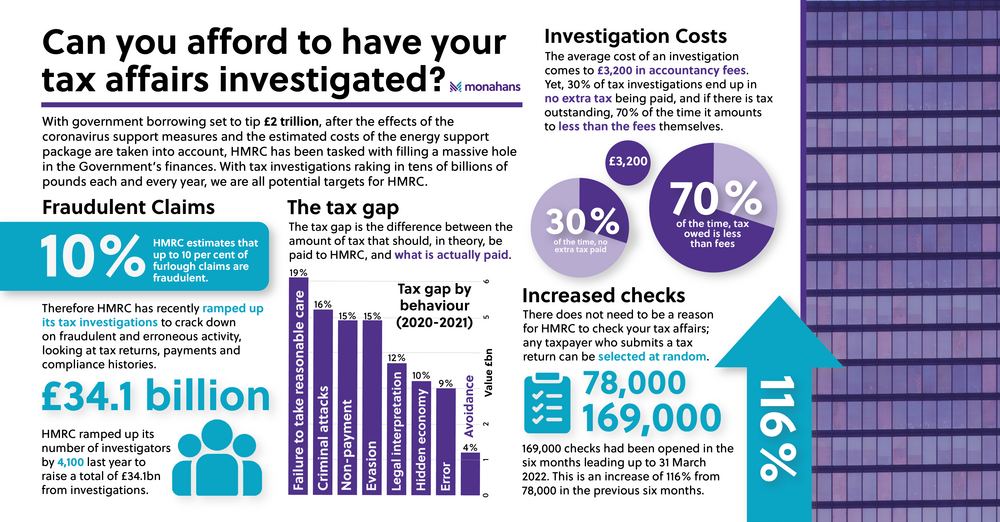

HMRC estimates that up to 10 per cent of claims are fraudulent – and many others will be made in error, albeit innocently – and it has therefore ramped up its tax investigations to crack down on this activity, looking at tax returns, payments and compliance histories. A specially deployed 4,100-person strong taskforce has gone some way to recouping these costs by raising £34.1 billion from tax investigations last year, and they’re not showing any signs of slowing down. Enquiries were up by almost 50 per cent at the end of last year and, unfortunately for many businesses, there does not need to be a reason for HMRC to check your tax affairs; any taxpayer who submits a tax return can be selected at random.

Being targeted for the investigation process can last for several months, if not years, and be disruptive, intrusive, stressful … and extremely expensive. The average cost of an enquiry weighs in at £3,200 in accountancy fees, which is a hefty sum when you consider that it’s not always about HMRC suspecting you of wrongdoing. In fact, 30 per cent of investigations result in no additional tax being owed, so you’re simply paying out significant accountancy fees when you’re entirely innocent. If there is tax outstanding, it usually (70 per cent of the time) amounts to less than the fees themselves.

Times are hard, and we get that, we really do – it’s our business to understand everything that our clients are going through – so any extra costs are largely unwelcome. But Monahans offers an annual subscription service that mitigates against the risk of being targeted for an investigation – and the ensuing fee – at a fraction of the price. Our Tax Investigation Service is designed to defend you if you are selected for an enquiry and support you through the stress and hassle of the process, whilst covering all of the costs you would otherwise be subjected to.

By way of example, HMRC launched a ‘Cross Tax Enquiry’ into one of our clients in the engineering sector – it has become increasingly common for checks to be launched on various industries, starting with a letter from HMRC advising that they want to carry out a routine PAYE or VAT check. From initially sounding fairly innocent, this can lead to a more in-depth enquiry that reviews all transactions across the business. The engineering company’s PAYE and VAT records were reviewed going back four years and increasingly detailed questions – over 100 of them – were asked that stretched out, despite the best efforts of the advisor, over two and a half years. Despite only minor adjustments being made to the company’s tax payments, the price of the process in fees was £35,000; a cost that was settled under the Tax Investigation Service.

Even if you’re entirely certain that your tax affairs are in order, HMRC is within its rights to launch a detailed examination of business documents and assets at your premises, ask for documents and information, make unannounced inspections and even go back up to twenty years to investigate matters. For the peace of mind of knowing we’ll be by your side should any of that happen, there really has never been a better time to subscribe to our Tax Investigation Service.

For more information on Monahans’ Tax Investigation Service, visit https://www.monahans.co.uk/tax-investigation

Dominic Bourquin