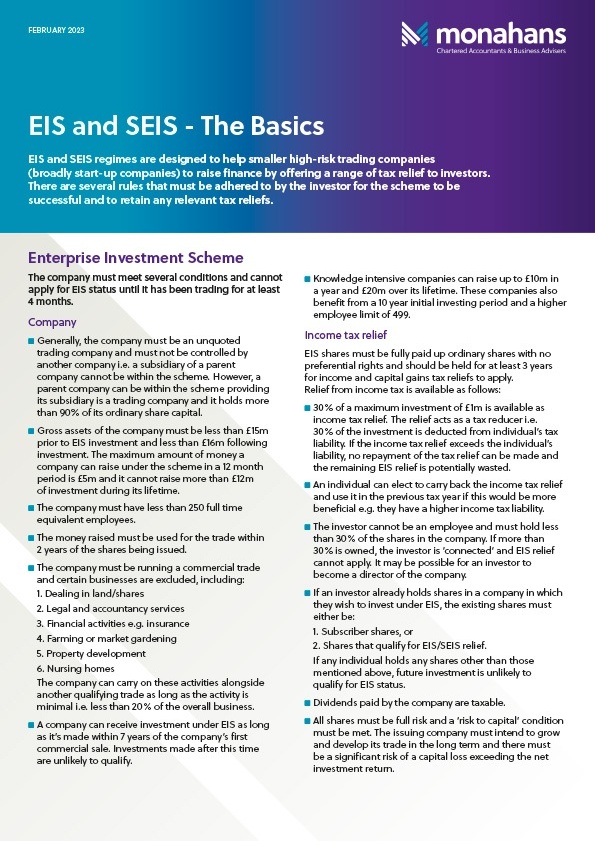

EIS and SEIS - The Basics

EIS and SEIS regimes are designed to help smaller high-risk trading companies (broadly start-up companies) to raise finance by offering a range of tax relief to investors. There are several rules that must be adhered to by the investor for the scheme to be successful and to retain any relevant tax reliefs.

Download our PDF to find out more.

Download publication