22 Aug 2024

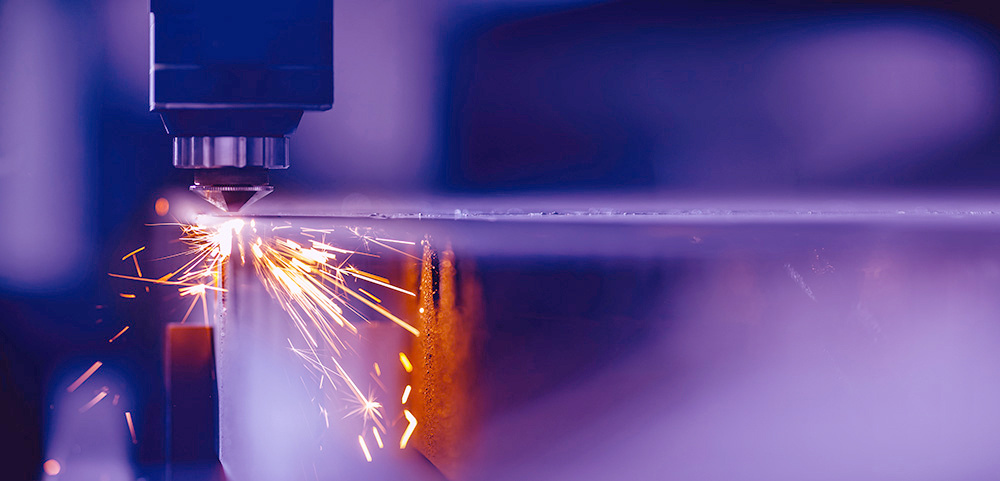

How Manufacturing and Construction businesses are faring - according to our research.

As the south-west’s largest chartered accountancy and advisory firm, it is crucial that we have a comprehensive understanding of the markets in which we operate, to ensure that the service we offer continues to meet the needs of our wide client base.

As part of these efforts, we commissioned a survey of management teams, senior executives, and business owners at more than 300 micro, small, medium and medium/large-scale enterprises throughout the region, to gauge how businesses have been faring over the last year.

At Monahans we work with businesses operating across a broad spectrum of sectors, so it is important to understand the unique set of challenges each industry is facing.

Manufacturing and Construction businesses, for example, have faced ongoing supply chain issues stemming from Brexit and COVID-19 disruptions. In 2022, there were an estimated 374,332 Value Added Tax (VAT) and Pay As You Earn (PAYE) registered construction firms employing 1.4 million workers. As of 2023, 2.7 million people were employed in the manufacturing sector in the UK and there were 138,440 registered manufacturing businesses.

We know that behind many of these businesses are hardworking individuals and teams who are navigating unpredictable market conditions, which is why we tailor our services to the unique needs and ambitions of each individual business that we work with.

We spoke with Iain Black, Partner, about the challenges that businesses operating in Manufacturing and Construction are facing.

Market stabilisation

Despite a challenging 12 months, businesses seem to be faring reasonably well. Respondents gave the buoyancy of the market an average score of 7.5 on a scale of 1 to 10 – the second highest of all sectors. Just over half (53%) reported an increase in turnover and 69% believe that they are in a better position than the previous year, which is in the top five highest figures across all sectors. 12% of which report being in a much better position.

This matches some of the stabilisation that we have been witnessing in the market, with supply chain issues beginning to improve. Businesses are also feeling quietly optimistic about the future, with 39% believing that the election will improve market conditions.

Challenges faced

That said, the rising prices that are impacting all sectors haven’t passed manufacturing and construction by. 41% reported inflation/rising operational costs as the biggest challenge faced in the last 12 months, followed by energy prices (39%) and supply chains (31%).

And this is set to continue in the next six months – with 39% envisaging that inflation/rising operational costs will be the biggest challenge faced, followed by recruitment/retention (29%), energy prices (29%) and generating new business (29%).

Energy prices and supply chains are areas where we expect to see businesses operating in as this space continues to need support. To navigate fluctuating prices, businesses will need to manage cashflow effectively, and continue regular forecasting, to have the best chance of getting ahead of any market changes coming their way.

Recruitment and retention were also highlighted as a challenge faced over the last 12 months. Despite 37% of businesses reporting an increase in headcount (averaging an increase of 23%), almost one in three (29%) were forced to make redundancies.

This matches the national trend of manufacturing and construction talent shortages. According to the latest Construction Skills Network (CSN) report, around 225,000 new construction workers are needed by 2027 to fill the current demand.

At Monahans our dedicated manufacturing and engineering team, has decades of experience in advising businesses of all sizes on a diverse range of areas from accounting and audit to tax.

Our services aim to ease some of the pressures faced by business owners, providing them with guidance on different elements of their business’ operations and finances and acting as that extra pair of hands. The advantage of our breadth of services, is that we can take every spinning plate into consideration and incorporate it into the holistic advice that we offer.

We have the knowledge and expertise to ensure the advice we give you is proactive and timely enabling you to focus on taking the business forward in such areas as minimising risk from pricing and supply fluctuations, optimising stock control and making important investment or acquisition decisions.

If you need support with the running of your business or would like to discuss your specific needs, please contact Iain Black or Martin Longmore who would be more than happy to discuss your options.

To download the full report, visit the Monahans website: https://www.monahans.co.uk/publications/swresearch-july24

Iain Black