2 Sep 2024

What our market research reveals about businesses operating in the agriculture sector

What our market research reveals about businesses operating in the agriculture sector

As the south-west’s largest chartered accountancy and business advisory firm, Monahans serves a range of businesses which operate across multiple sectors.

To ensure that our services are meeting the needs of our clients, we are always eager to find new ways of measuring the sentiment of the markets in which we operate. As part of these efforts, we decided to survey more than 300 micro, small, medium and medium/large-scale enterprises throughout the south-west, to gauge how they’ve been faring over the last year and what challenges they are likely to face in the coming months.

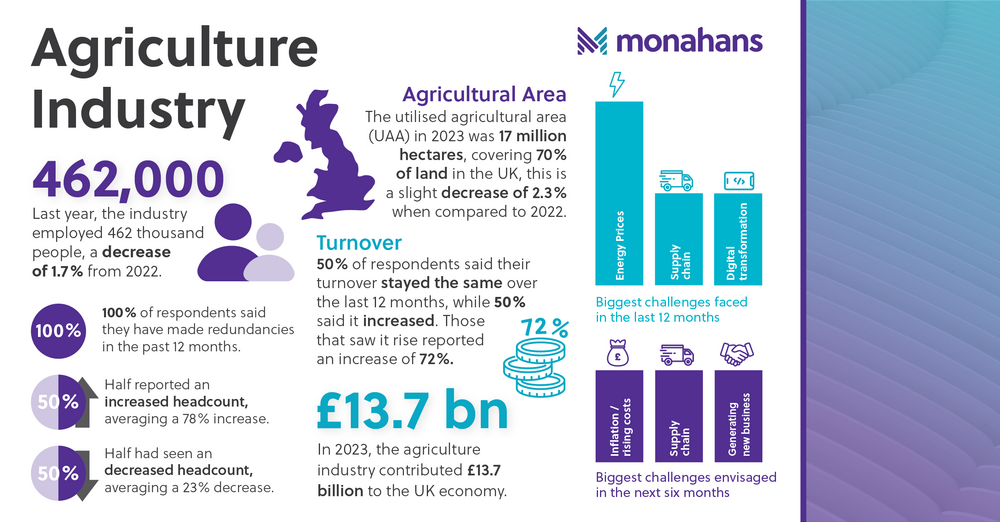

The research spans multiple sectors, including businesses operating in the agriculture industry. Not only do these organisations account for a significant portion of our client base, but they are also crucial to the economy. Last year, the agriculture industry employed 462,000 people and contributed £13.7 billion to the UK economy. The utilised agricultural area (UAA) - the total area taken up by arable land, permanent grassland, permanent crops and kitchen gardens, covers 17 million hectares - 70% of land in the UK.

We speak with Andrew Perrott, Partner and head of our Rural Business and Landed Estates team, about the findings, and the challenges that he is seeing farmers face in 2024.

What position are organisations in?

The questionable British summer in 2023 had adverse effects on the harvest season which put pressure on farming businesses. Fast forward a year, and it is encouraging to see half of survey respondents (50%) reporting they are in a better position than the previous year, despite the variable preharvest weather we have been experiencing.

Market buoyancy is also evident from the research findings, with half of businesses reporting an increase in turnover and averaging an increase of 72% - the highest of all sectors, as well as respondents giving the buoyancy of the market an average score of 7.0 on a scale of 1 to 10.

To keep up with the rise in demand, businesses in the agriculture sector reported the highest increase in headcount across all sectors, also indicating stability in the market.

What challenges are your clients facing at the moment?

Energy prices, supply chains and digital transformation are amongst the biggest challenges faced by agriculture businesses over the last 12 months. And looking ahead to the next six months, inflation/rising operational costs, supply chain and generating new business are key areas of concern.

Cashflow also remains an ongoing area of focus for rural businesses, particularly against a backdrop of rising operational costs amid fluctuating harvest levels. Farming is a volatile industry with farmers needing to wait at least 18 months to see a return on investment on a crop or an animal. They also have no control over what the end market price will be, which makes yearly results incredibly unpredictable.

This makes sound business advice and financial planning support all the more critical. Whilst no-one can predict the future, having up-to-date information allows businesses to make calculated decisions about what they don’t know, based on what they do know.

Because of the unique nature of farming, consultative support is just as vital as technical knowhow. Much of our work at Monahans centres around helping clients to navigate legislation changes and talk through any issues. The nature of farming often adds levels of complexity to traditional financial planning, so having an understanding of the full picture is crucial.

Typically, our team meets with clients regularly over the course of a year to proactively help with the running of their business. Where possible we aim to pre-empt any issues before they occur, but we also seek to do so on a realistic basis – after all, clients need to be able to continue to run the business on a day-to-day basis.

Our team is well placed to support you in navigating fluctuating market conditions and implementing effective forecasting and forward planning, helping you to get out ahead of any changes on the horizon. Get in touch today.

To download the full report, visit the Monahans website: https://www.monahans.co.uk/publications/swresearch-july24

Andrew Perrott